If there was one headline from the last year with regards to the housing market, it has been the historically low rates.

At their low, the average rate for a 30 year fixed mortgage was as low as 2.65%. For context, many of our parents purchased the homes many of us grew up in at a staggering 18% mortgage rate in the late 1970's/Early 1980's! Even the 6.5% we saw in the late Aughts seems eye popping by comparison, which was a historical low back then.

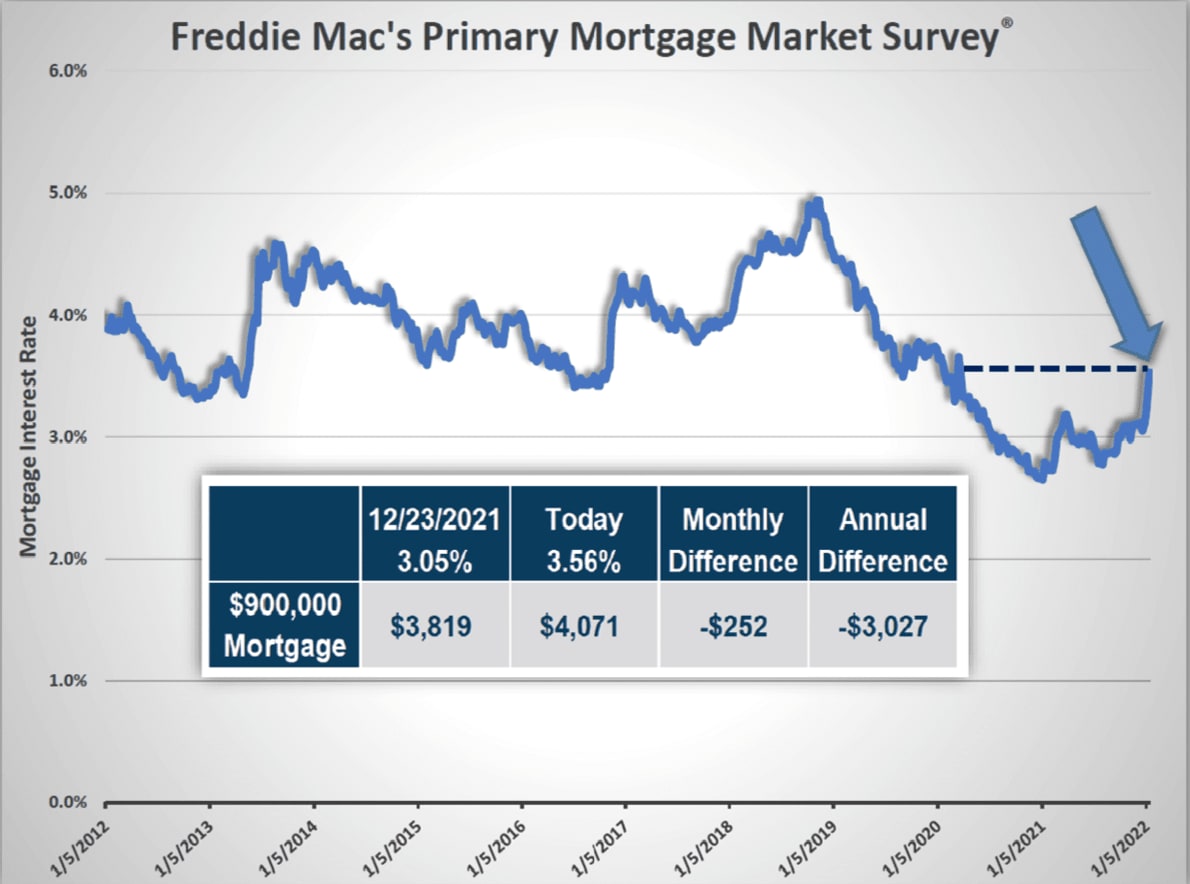

Prior to the pandemic, mortgage rates were trending around 3.5% (a historic low at the time). So it's not hard to see why demand exploded last year. From a rate standpoint, this was the housing equivalent of a "25% off One Day Sale" at Macy's.

As the saying goes, "all good things must come to an end", and for now, it appears that rates are starting to find their way back to their prior levels. For this week, the average rate for a 30 year fixed loan stands at 3.55%, up .5% from where we were at the beginning of January. Of course, media headlines will be sensationalized, proclaiming "mortgage rates soar!" and "highest rate in 2 years", and while this is true on the surface, it's important to remember that we are STILL historically low (remember that 18% I mentioned earlier??).

This was not unexpected, (and I had highlighted this in my 2022 Market Forecast newsletter), as many economists had projected rates to rise to 3.7-4% by Q3. The Fed had signaled it would be tapering its purchases of mortgage backed securities, which had been pumping liquidity into the market and allowed lenders to charge lower rates, and has in fact stepped up its efforts as it continues to curb inflation.

What Does This Mean?

For starters, buyers should expect some impact to their purchase power. This additional spike in rate will mean that an average mortgage for a $900,000 home will cost about 4-6% more per month than it did a month ago. That may be a tough pill to swallow in a rapidly appreciating market, but as rates may climb closer to 4% towards the end of the year, it is still advantageous to make a purchase now.

*credit, Reports On Housing

Will this impact overall demand? Slightly, but not enough to impact the market. Some individual buyers may see themselves bumping down to a lower pricing category if they had been stretching themselves during the last year. However, with inventory as lean as it is (-50% in San Diego), there is still too much demand relative to the supply. In 2013 and in 2018, we did see the market cool down dramatically when rates climbed well over 4%. In this market, with prices hitting record highs, we will likely see demand being to level off and inventory pick up the closer we get to, or surpass 4%. Until then, expect it to remain a Super Hot Sellers Market.

Will this impact homeowners looking to refinance? Yes, especially anyone who purchased during the last year at the record low rates. To quote a recent article in Marketwatch.com, "the opportunity to save money by refinancing thanks to the interest rate alone has likely passed". Lenders are seeing the cash-out refinance volume drop dramatically.

Here is a great article in Marketwatch about the current rates that I found interesting. For more information, or to discuss the best real estate strategy for you, click on the "subscribe to newsletter" link below, or contact me directly at 646.221.2830.

Ehab Ismail | The Kim Hawley Group | Compass | DRE#02034817